Insur;Hack, Egypt’s first insurance technology hackathon, was launched in an effort to connect aspiring entrepreneurs and early-stage startups’ teams with all parties in the insurance sector. The goal is to encounter the challenges of an industry in dire need of renovation although it makes up 0.91% of Egypt’s GDP (Gross Domestic Product). Twelve teams competed for a prize pool of EGP 120,000 in grants and a study tour to explore the insurance technology scene in Germany. Representatives from top insurance companies in the country, the Egyptian Financial Regulatory authority and the Insurance Federation of Egypt attended the event.

Head of Programs: Promotion of Financial Inclusion in the MENA Region and SME Finance in Egypt at GIZ – the German Corporation for International Cooperation

GIZ (the German Corporation for International Cooperation), the Financial Regulatory Authority, the AUC Venture Lab, the Insurance federation of Egypt, and Insight2Impact partnered to create the platform InsurTech Egypt and – in turn – InsurTech Egypt’s first mission was to kick off Insur;Hack.

The participants were tasked with coming up with solutions for developing data analysis and assessment tools for insurance companies, transforming the insurance agent (for example, through using chatbots), reaching low-income insurance segments and utilizing insurance to create a competitive edge for SMEs.

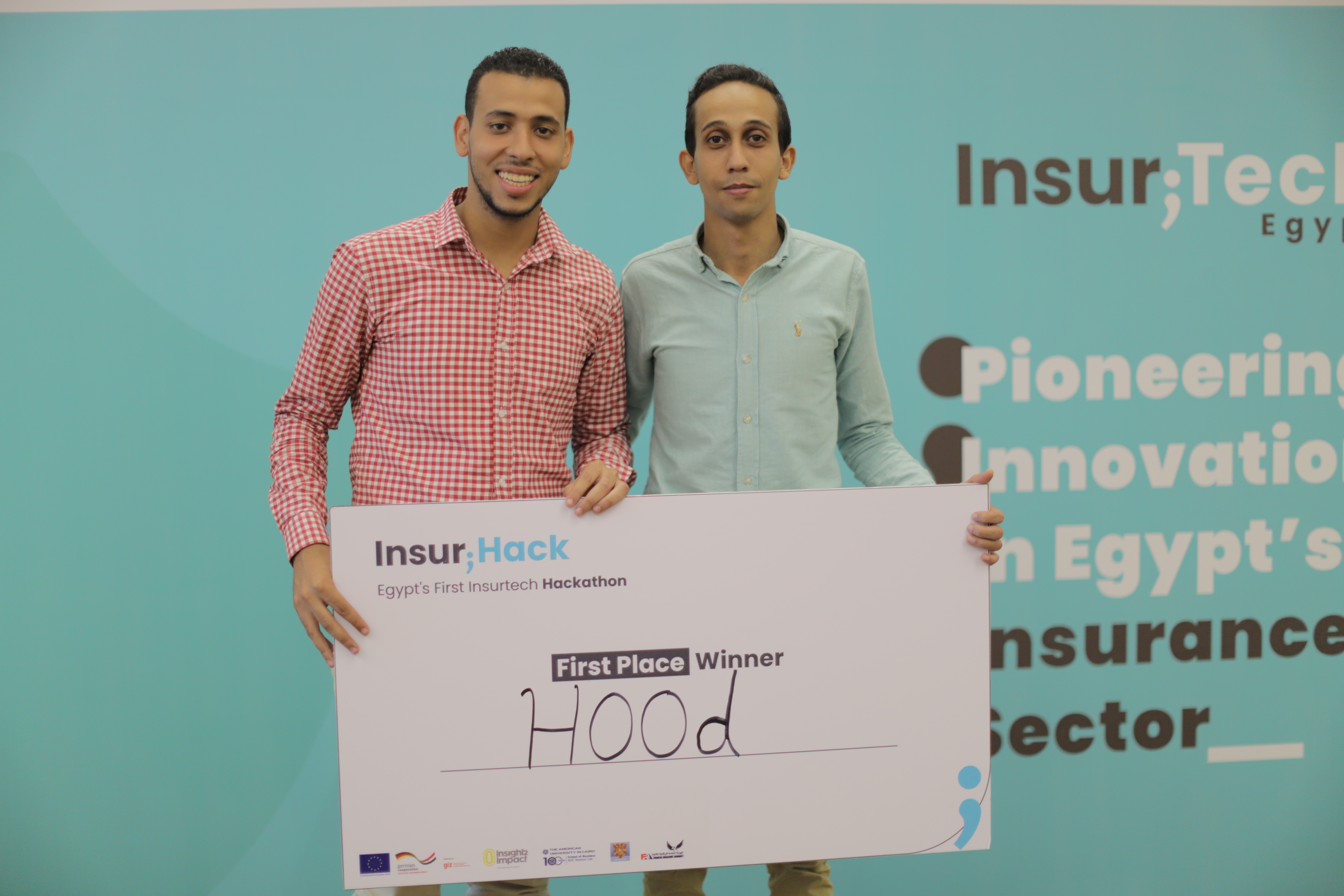

1. Hood

Hood introduces a service that – according to their slogan – reads your car’s mind. Their plan is to provide a database with drivers’ habits and behaviors and offer it to insurance companies so they can make more informed decisions and create more customizable and elaborate plans.

2. Mazboot

Mazboot makes sure diabetics don’t have to spend tons of money on insurance that isn’t tailored to them and hence wastes a lot of their money. It also allows them to self-regulate and monitor their illness or get a doctors’ consultation. This, they argue, will also help insurance companies save money by minimizing the costs they expend on diabetes’ complications.

3. MerQ

MerQ delivers an artificial intelligence system that allows consumers to consult credible and trustworthy chat bots in matters and terminologies related to financial and insurance services. One of the bots, Sally, has already been activated and used by over 200,000 people. You should consider trying it!

4. Insta-Insure

Insta-Insure’s main aim is to save time and money for both insurance companies and their customers by making the claims’ operations cycle faster. They plan on doing so through digital platforms and an app-based system.

5. Be3Mahsolak

Be3Mahsolak wants to make it easier for insurance companies to offer farmers insurance services tailored to their needs. They plan on doing so through providing insurance companies with a continually updated database on farmers with the information that’s most relevant to building solid insurance plans.

6. ElZatona

ElZatona is a cloud-based platform that focuses on growing small and medium retailers through delivering affordable insurance add-ons on their services.

7. Bringy Digital Ventures

Bringy Digital Ventures is all about offering non-banking digital financial transactions to SMEs (Small and Medium Enterprises) and middle-class consumers. Amongst these services are insurance companies that are affordable because – thanks to the digitization of the process – a lot of overheads and operation costs have been cut down.

8. AlfSalama

AlfSalama offers E-claiming management software to insurance companies through OCR and data analysis tools and acts as a chat bot between medical insurance companies, healthcare providers and patients.

9. Amanleek

Scams and frauds around and within insurance companies caused a lot of people to opt out of their insurance plans and distrust the sector in general according to the Amanleek team. They’re here to restore that trust through a website that transparently unravels the intricacies of the insurance plans and easily draw comparisons between them. Building a competitive edge for SMEs, Amanleek also offers an end-to-end digital platform to ease the purchasing and management process between consumers and insurance companies in Egypt.

10. InsuranceHub

Helping the insurance companies to gather anonymized data without violating consumers’ privacy is what InsuranceHub aims to achieve through the usage of Al algorithms.

11. ClickMare

Focusing on the medical industry, ClickMare customizes annual programs that offer different packages for consumers and provides insurance companies with the exact data they require to create elaborate and customizable plans.

12. InsureAPI

Targeting two-sided marketplace startups, InsureAPI vends insurance policies to the consumers. They also provide insurance companies with the data they need to reach out to these potential customers. This process is achieved by machine learning and it offers API integration and a dashboard for use by insurance companies.

Insurtech invited a panel of five judges that includes illustrious names to determine the winners at the end of the Hackathon.

The judges includes different high profiles among them Mr. Hayder Al Bagdadi, Head of projects at GIZ. Also, Mr. Hisham Ramadan, Insurance Senior Advisor at the Financial Regulatory Authority, Mr. Alaa El-Zoheiry Chairman of the Insurance Federation of Egypt, Managing Director of GIG- Egypt. Dr. Ayman Ismail, the Founding Director of AUC Venture Lab and AUC Angels and Ms. Renee Hunter, a Research Associate at indight2impact facility and Cenfri.

Meet the Winners

After three days of persistently developing ideas, the winners are announced to come in the third place Amanleek, winning 30,000 EGP. In the second place comes MerQ, winning 40,000 EGP and finally in the first place, Hood team, winning 50,000 EGP and a study tour in Germany.

The team of Amanleek posing for a photo with their grant.

MerQ celebrating their win at Insur;Tech Egypt’s Insur;Hack

The team members of Hood after the victory.

Stay tuned to find out more about the teams and organizers planning to change Egypt’s insurance industry through AI, data analysis and more.

Additional reporting Mai Ahmed